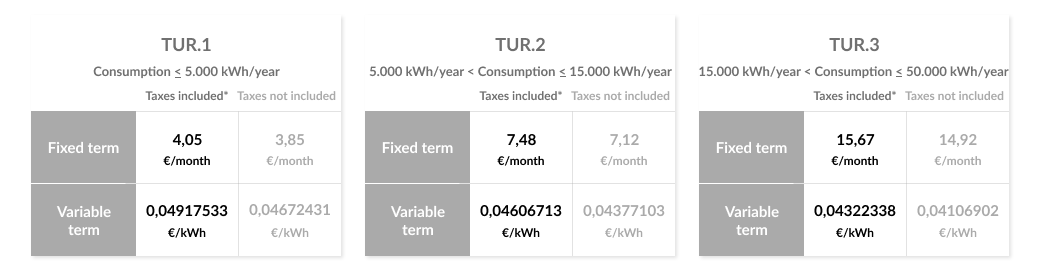

Gas LRR are composed of a fixed billing term and a variable billing term per unit of energy.

Prices vary on a quarterly basis. The Ministry is responsible for updating them in accordance with current regulations. Resolution where LRR is published.

These prices include the amounts of network access tolls and charges, which are regulated items established in Circular 6/2020, of 22 July, of the National Commission on Markets and Competition (tolls); and Royal Decree 1184/2020, of 29 December, of the Ministry for Ecological Transition and the Demographic Challenge (charges).

Prices in force from 01/07/2023

* The taxes applicable at all times and which will be broken down on the bill will be: for the supply of electricity the Electricity Tax (5.113% or 0.5% or the minimum amount of €0.5/MWh or €1/MWh, or as applicable by law) and for the supply of gas the hydrocarbon tax (€0.00234/kWh or as applicable by law). In addition, VAT is applied in mainland Spain and the Balearic Islands (21% or 5% or as applicable), IGIC (0%, 3% or 7% or as applicable) is applied in the Canary Islands and IPSI (1% or 4% or as applicable) is applied in Ceuta and Melilla. Insurance includes taxes (IPS), the Insurance Compensation Consortium surcharge and brokerage fees, which are not subject to VAT.